The Endowment

Related Links

TRIP Investment Policy

The mission of the University of Chicago’s Office of Investments and the Investment Committee of the Board of Trustees is to provide stewardship of the University’s investment assets. This includes managing the University’s endowment to support the University’s academic and medical programs and ensure that the endowment benefits both current and future generations. The University’s endowment is largely invested in the Total Return Investment Pool (TRIP).

The investment objective of TRIP is to achieve a return consistent with a level of risk that is appropriate for the University and the Medical Center. The Office of Investments takes a Total Enterprise Asset Management (TEAM) approach in designing the investment strategy of TRIP. A TEAM approach takes into account the economic risks borne by the University, such as growth objectives and debt ratios, in selecting an appropriate level of risk for TRIP. Our primary measure of risk in the portfolio is the Global Equity Factor (GEF), a metric that is similar in concept to beta. Through the TEAM approach, the Office of Investments, in consultation with the Investment Committee, has determined that a portfolio with a long-term central tendency GEF of 0.80 is appropriate for the University. TRIP’s GEF may vary within the policy range of 0.70 and 0.90.

Additionally, the long-term strategic policy seeks to target the portfolio’s exposure to private assets of approximately 35 percent in normal market environments. The portfolio is currently in line with its private investment target. Private asset class exposure may vary widely depending on market conditions. Should there be material changes to the financial conditions of the University or investment markets, the Office of Investments and Investment Committee will revisit these parameters.

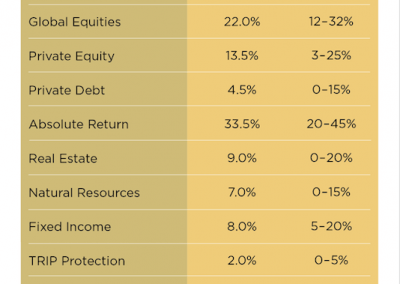

TRIP invests in a broad array of assets, including global stocks and bonds, real estate, natural resources, private equities, hedge funds, and portfolio protection (tail hedging) strategies. The Office of Investments achieves exposure to these categories by selecting and engaging external managers. The Office of Investments may also make direct investments and co-investments, and use exchange traded derivatives to ensure adherence to investment policy and risk parameters. In seeking to maximize returns given these risk parameters, the Office of Investments recommends an annual investment plan of broad asset class ranges and a private investment commitment budget. The annual investment plan is an implementable policy statement of our TEAM-driven risk and liquidity targets. The Investment Committee of the Board of Trustees annually reviews and approves the investment policy statement (see table 1).

Investment Performance

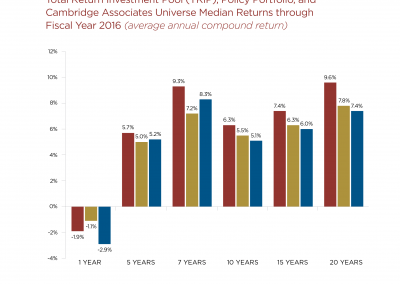

The University of Chicago’s endowment finished fiscal year 2016 with a market value of $7 billion, including $873 million of Medical Center endowment and $76 million of Marine Biological Laboratory endowment. Ninety-six percent of the endowment is invested in the Total Return Investment Pool (TRIP). TRIP’s return for the fiscal year, net of outside management fees, was –1.9 percent, which generated a $175 million loss for the endowment. The average compounded investment result for the University over the last five years is a 5.7 percent gain; the average since the financial crisis* is a 9.5 percent gain; the average over the last 10 years is a 6.3 percent gain; and the average return over the past 20 years is 9.6 percent. TRIP’s return has outperformed the market-based, policy-weighted strategic benchmark used by the University over the long term.

Over the same time periods, TRIP returns have been favorable compared with the Cambridge Associates universe of colleges and universities median returns, even as the University has implemented a lower risk profile than most peers (see figure 1). The University and its trustees have selected an endowment strategy that is consistent with its total enterprise, long range planning strategy in pursuit of academic eminence.

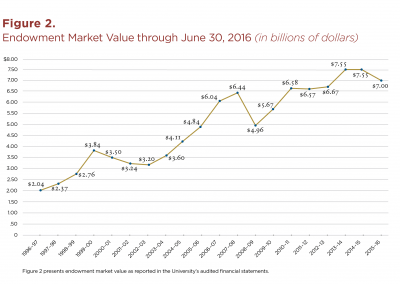

World markets experienced an underwhelming year in fiscal year 2016 led by weakness in the global public equities and commodities markets. Despite the challenging environment, the endowment has produced near double-digit returns since the financial crisis in 2008 and 2009. The investment returns earned by TRIP have added $4 billion in value to the endowment since the financial crisis and have funded $3 billion in payouts to the University and its affiliates in the same period. Over the past two decades, the endowment has grown from $2 billion to its current level of $7 billion and has been boosted by solid investment returns, generous alumni support, and prudent spending (see figure 2). TRIP’s results reflect positive returns from equities, private markets, and bonds, together with strong performance by the University’s investment managers.

The Role of the Endowment

The fundamental purpose of the University’s endowed funds is to support the core academic mission of the University by supplying a steady source of income to supplement the operating budget. Currently, the endowment provides 18.2 percent of total revenue.

Spending from the endowment is used primarily for academic purposes, going toward academic programs, instruction and research, faculty salary support, student aid, library acquisitions, and maintenance of the buildings and classrooms.

Maintaining and growing the value of the endowment over time is critical to ensuring that the steady source of income the endowment provides will not be eroded. At the University of Chicago, that is accomplished in a number of ways, including implementation of a well-diversified portfolio and a conservative spending policy.

Endowment Spending

The control of endowment spending, a critical factor in maintaining value over time, is a responsibility that is vested in the trustees of the University. Each year as part of the budget process, the trustees are asked to approve a level of spending that is within the range of 4.5 to 5.5 percent of a 12-quarter average market value, lagged one year. The current spending rate is 5.5 percent. The flexibility afforded the trustees by virtue of the range allows them to lower the rate of spending during periods of market appreciation and to increase it during periods of decline. The current spending rule, which was implemented with the fiscal year 2005, is designed to strike a healthy balance between long-term asset preservation, prudent spending for current operations, and capital budget support. It has the added benefit of protecting the payout from sudden swings or shocks in the financial markets.

* March 31, 2009, through June 30, 2016, annualized